What is a Fintech Web Design Agency?

Fintech is essentially synonymous with fast— the fintech space moves quickly as technology continues to evolve, meaning companies in the financial sector that provide digital banking, peer-to-peer lending, and other fintech services need to ensure their products are constantly adapting to meet consumers’ changing needs and expectations.

This fast pace means that having an agency for your technology web design that understands the fintech industry is critical. Whether you’re developing fintech apps, digital banking platforms, or wealth management solutions, our fintech web design agency brings relevant expertise in UX design, UI design, and digital strategy to empower users and create intuitive interfaces that foster customer trust and satisfaction. With a detailed timeline and market research-driven approach, we ensure your fintech design project aligns with your business goals and resonates with your target audience, giving you a competitive advantage in the financial sector.

How Our Web Design for Fintech Companies Helps You Get and Stay Ahead

People in the fintech space often face challenges when it comes to their web design, which is often related to building trust, ensuring security, and simplifying complex financial processes for users.

With sensitive financial data at stake, website visitors need reassurance that their information is safe and protected from cyber threats. Plus, navigating through intricate financial products and services can be daunting for some users, which can potentially lead to frustration and abandonment.

Good web design addresses these issues by incorporating robust security measures, such as encryption and two-factor authentication, to safeguard user data and build trust.

Intuitive user interfaces, clear navigation, and informative content also combine to streamline the user experience, making it easier for customers to understand and utilize financial products effectively, whether it be a fintech product, a fintech app, or other fintech solutions.

The Elements of a Successful Fintech Site

Develop Buyer Personas

These buyer personas represent different segments of potential customers who may visit a fintech website, each with unique needs, preferences, and priorities. Tailoring marketing messages, product offerings, and customer support initiatives to address the specific pain points and requirements of these personas can help fintech companies effectively attract and retain customers. Here are some common buyer personas for a fintech website:

Answer Top Questions

A fintech website should address a range of questions to effectively inform and engage visitors. By addressing these questions on your fintech website, you can effectively educate visitors, build trust and credibility, and drive engagement and conversions. Here are some top questions it should answer:

Highlight Your Most Solid Case Studies

A fintech website should include case studies or success stories to showcase real-world examples of how its solutions have benefited users and businesses. These narratives provide tangible evidence of the effectiveness and value of the fintech offerings, illustrating how they have addressed specific financial challenges, improved efficiency, and driven positive outcomes.

By highlighting successful implementations and quantifiable results, case studies or success stories serve as powerful testimonials that build credibility, trust, and confidence in the fintech company’s capabilities. They provide potential customers with insights into the practical applications and potential benefits of the solutions, helping to alleviate concerns, overcome objections, and ultimately, persuade visitors to invest in the fintech offerings.

Provide a Strong Call to Action

By strategically placing these CTAs throughout your fintech website and aligning them with the visitor’s journey and intent, you can effectively engage prospects, generate leads, and drive conversions. Here are some common call-to-action (CTA) options that a fintech website should consider incorporating:

Our Fintech Web Projects

Our team at Sayenko Design has worked as a fintech design agency for many years, offering fintech companies our expertise in UX design, the user journey, and more. Despite the unique challenges that financial services may face online, we focus on UX research and the digital experience to bring fintech projects to life online.

In our work with StockDweebs, we built an e-commerce platform with an API to show the live prices of stocks and data.

Proven Success in Fintech

We don’t just offer fintech solutions— we provide them, and the proof.

Committed to You

We pride ourselves on getting to know your fintech company, fintech app design, and all your digital products inside and out.

Customer Service

We aim to deliver exceptional results, and to deliver them on time, taking pride in our customer service.

Fintech Designs Audiences Love

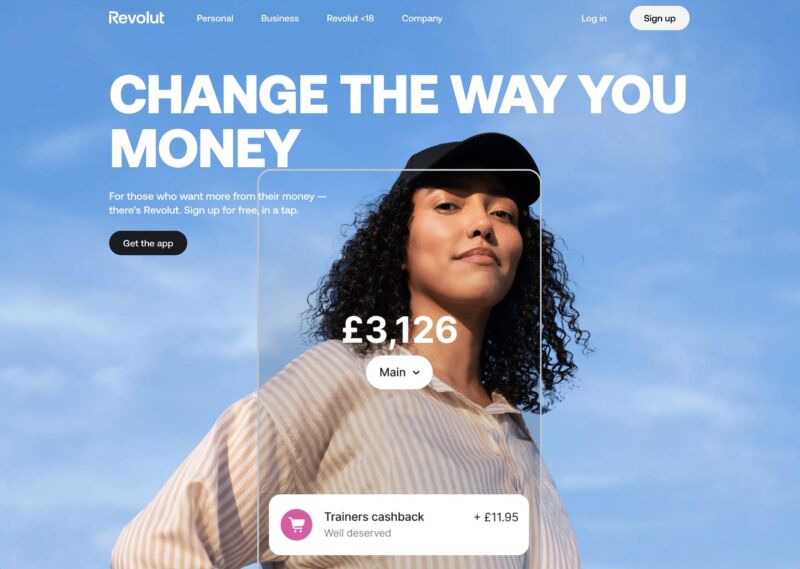

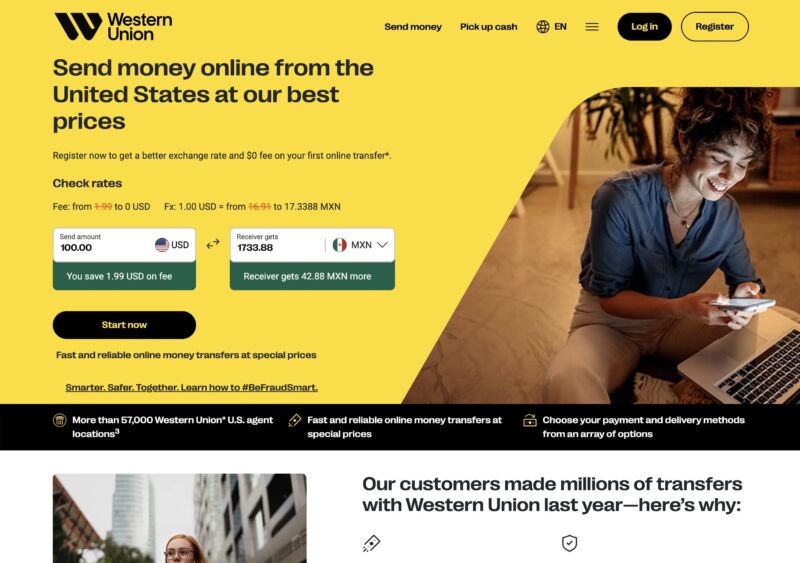

Whether it’s making digital payments simple, providing educational resources, or explaining the importance of wealth management, web design that a user enjoys interacting with is key. These designs showcase a dedication to the customer experience.

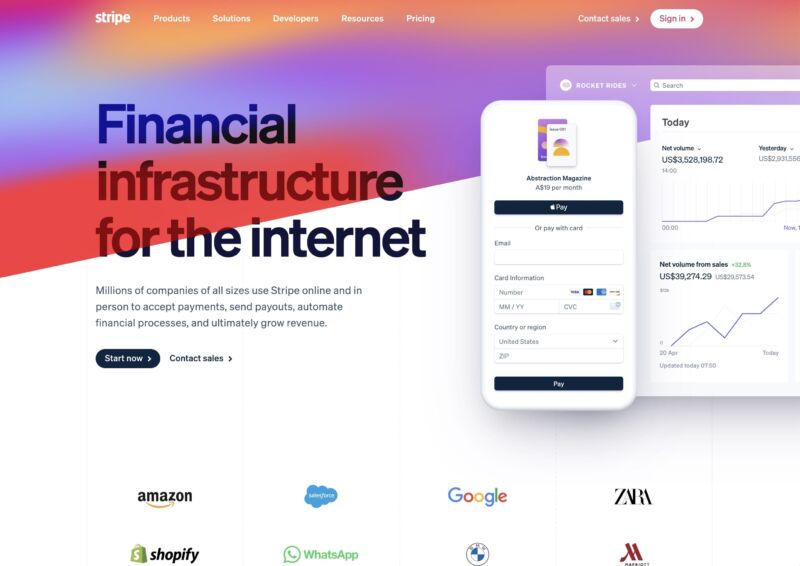

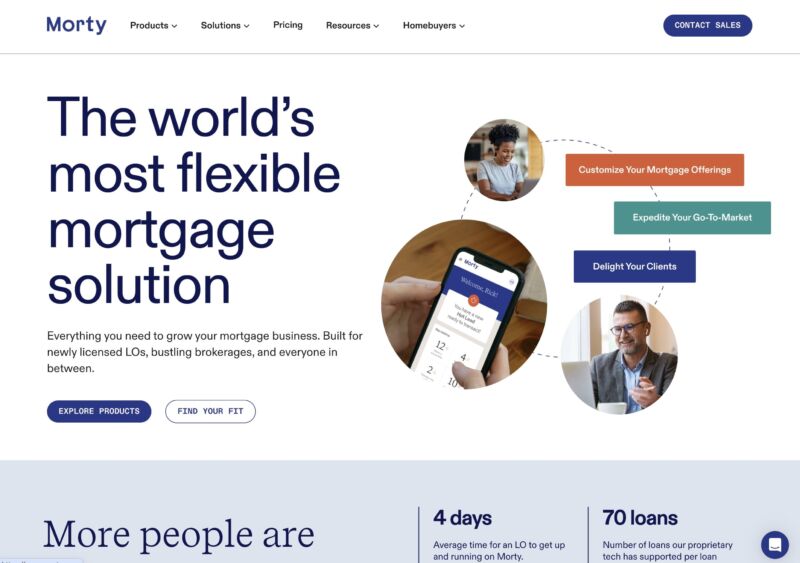

Stripe

Standout design elements: Bold colors, clean background, easy scrolling, interactive elements

Standout design elements: Simple color scheme, easy to create an account, blog posts, easy-to-use

Standout design elements: Fun animations, engaging background, bold colors

Standout design elements: Simple white background, easy-to-read font, use of tools such as calculators

Standout design elements: Easy navigation, custom graphics, engaging copy

Standout design elements: Appeals to a younger demographic through copy and images, simple color scheme, explains fund transfers easily

Standout design elements: Calculator tools, easy navigation, custom graphics

Standout design elements: Engaging background, simple language, fun to scroll through

Standout design elements: Bright colors, simple font, easy to navigate

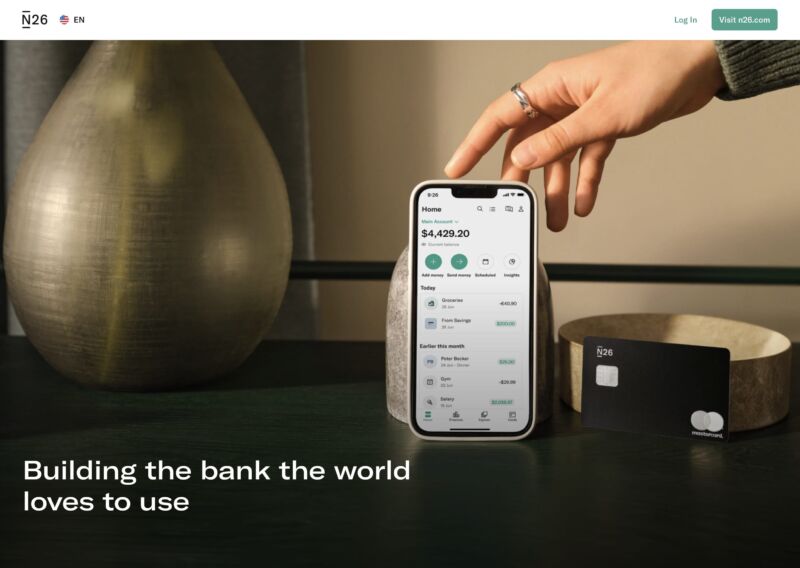

Standout design elements: Contemporary look, eye-catching background, simple font

Your Fintech Design Agency Questions Answered

Our Fintech Products Website Design Process

We get to know you and your fintech business in the Discovery phase, exploring the fundamental aspects of who you are, what services you provide, where you operate, how your operations function, and why you’re passionate about fintech. Utilizing comprehensive questionnaires, extensive meetings, and diverse communication methods, we learn valuable information about your motivations and objectives and use this understanding to inform the strategic direction of your website design.

Next, our attention shifts to crafting a bespoke conversion strategy aligned with your fintech business goals while designing an informational architecture to guarantee intuitive navigation for users. We use high-level messaging and conduct thorough keyword analysis to optimize your website’s content. Then, we employ wireframes as the foundational blueprint to guide the layout of your fintech website.

At the heart of our process is the user experience, where we analyze each interaction from the perspective of the end user. Our fintech UX design approach ensures that the final product is not only intuitive but also exceptionally user-friendly, enhancing engagement and satisfaction.

During the development phase, we translate your vision into reality by crafting a custom theme that mirrors your brand identity and core values. We then seamlessly integrate Google Analytics and Search Console, providing you with valuable insights into user behavior so you can make data-driven decisions.

We conduct cross-browser testing to guarantee that your website functions well across various browsers and all types and sizes of devices, ensuring a seamless and consistent experience for all website visitors. This phase also includes user research and testing to enhance the overall customer experience.

As we near the end of your project, we provide extensive training to give you the necessary skills and tools for managing and maintaining your website effectively. Tailored to your specific requirements, our training ensures you can confidently navigate and update your site with ease so you can continue to promote your fintech product with confidence.

Our Bold Promise

We deliver cutting-edge website design solutions for fintech companies that not only meet but exceed industry standards, ensuring optimal user experience, security, and compliance.

A Word from our Client

“The site has received a lot of positive feedback. Although there has been very little promotion, there has been an increase in lead generation and SEO rankings are higher. The Sayenko Design team is very knowledgeable, and they were able to provide valuable recommendations that improved the site.”

~ Mark Bomber, VP of Marketing

Our Other Services

Biotech Web Design

Our biotech web design services excel in communicating the unique value of each company, from highlighting cutting-edge research to showcasing scientific breakthroughs, ensuring that their message resonates effectively with their audience.

SaaS Website Design

Our designs for SaaS companies are crafted to engage target audiences, drive conversions, and foster customer trust, all while maintaining a visually appealing aesthetic that reflects the brand’s identity and values.

Cyber Security Web Design

Our web design service for cyber security companies is tailored to instil confidence in users, emphasizing trust and security while delivering seamless navigation and engaging user experiences.

IT Company Website Design

Crafted with precision and functionality, our website design solutions for IT companies highlight your business’s services and seamlessly guide visitors through your offerings, ensuring an unforgettable user experience.